In this edition we explore weather events, natural disasters, pandemics, war, etc. and some related impacts on unclaimed property reporting. We also provide a NAUPA III update.

The Linking Assets Team

extends to you the warmest of

Seasonal Greetings.

Weather Events, Natural Disasters, Pandemics, War, etc. and the Impacts on Unclaimed Property Reporting

The massive destruction of a significant weather event such as a hurricane or natural disaster such as a wildfire is devastating and impacts everyone in its central area and beyond. We can now add “pandemic” to the list of events interrupting and delaying business-as-usual. Unfortunately, the disruptions to daily life are not limited to our home lives but spill over to all aspects of life, including business.

Unclaimed property reporting requirements continue even in the wake of weather or natural disaster or a pandemic. Banks, credit unions, financial institutions, as well as other holder types should attempt to conduct owner outreach mailings as required by State statutes. Depending on the State, a financial institution may have several months to find owners before required unclaimed property reporting is due.

Complicating attempts to reach out to owners by mail are the neighborhoods where houses are uninhabitable or worse, have been destroyed. Likely, mailings sent to these addresses would only get to the owner if a mail forwarding request has been submitted. Also, there may be zip codes where postal service disruptions remain. (A current listing of postal service impacts by State, for residential customers, is available.[1] ) With the pandemic, international postal service was shut down to some countries (A current listing of postal service suspension by country, is also available.[2] ) Not surprisingly, there is a suspension of mail service to Ukraine due to the ongoing conflict there.

Surely, mailing to inaccurate or non-deliverable addresses will generate return mail and require time and costs to process it. Additionally, it can increase the risk of fraud for mail to be delivered to incorrect mail recipients. With accurate addresses more mail gets through, allowing unclaimed property holders to reconnect with and reactivate their customers, members, accountholders, and other owners—and avoid reporting and remitting property to the State.

When statutory due diligence cannot be performed, due to postal service disruptions, what should a holder do? Efforts beyond mailing to the address of record can be pursued. Searches for better addresses could be performed, this might lead to an address in a different zip code, state, or where mail is being forwarded (temporarily or permanently).

This combined with robust outreach of email and telephone could be leveraged and could result in reconnecting with more owners. Ultimately, this robust outreach can result in less unclaimed property to track, maintain, process, and report. Reuniting more property with owners accomplishes the overarching goal of unclaimed property—to return property to its owner.

While in some states, statutes or allowable extensions may provide relief if property cannot be reported on time. An unclaimed property division may have a process to pursue to have penalties and/or interest waived, in full or in part, if an unclaimed property holder can show good cause for the late filing. However, late filing provisions like these are not universal.

For example, Florida unclaimed property statutes include provisions that, while not specific to any particular type of disaster, allow late-filing penalties to be waived, fully or partially, if an unclaimed property holder can show good cause. Florida statute [3] stipulates “If the holder acted in good faith and without negligence, the department shall waive the penalty provided herein.”

California has been proactive on situations related to natural disasters for many years. For instance, the California Unclaimed Property Division published a “Notice to Holders” in response to Hurricane Sandy in October 2012 and to Hurricane Ian in October 2022. [4] These notices outlined “Guidelines for Extension Requests” due to each of these natural disasters.

For Hurricane Sandy, the Division allowed an extension of 2 weeks for eligible holders for reports due October 31, 2012, extending the due date to November 13, 2012, if a holder was eligible. While for this year’s Hurricane Ian, the Division allowed extensions to businesses, and agents reporting on their behalf, that have been affected by Hurricane Ian for reports due before November 1, 2022. Any life insurance companies, and agents reporting on their behalf, that have been affected by Hurricane Ian may file a request to extend the deadline for Remit Reports due between December 1 and December 15, 2022. Each notice included instructions for which forms to complete and how and when to file for the extension.[5]

In California these extension requests are considered on a case-by-case basis depending on the situation and impact to the business or agent. While a new due date was not outlined in the notice, holders were advised to submit extension requests as soon as possible.

Again for California reporting for both events, “qualifying conditions include serious occurrences that severely limit the ability of the holder or agent to submit the specified report because of significant disruption of normal business activity, or impacts to communications, building access, transportation, or mail and parcel delivery.” [6] Further, the division advised that any holders or agents of holders who can submit their Remit Reports and remittances during the original reporting period are encouraged to do so, as the unclaimed property division continues to process unclaimed property reports and claims.

As for Covid, many states and companies had some form of shut down during 2020. As onsite staffing was diminished: sending statutory owner notifications/due diligence, signing reports, sending paper reports with electronic media, and remittances were all difficult. To accommodate for these shutdowns some States made permitted allowances and adjustments. As an example, Georgia allowed for electronic means for submitting reports rather than requiring the customary paper reports with accompanying electronic media.

With California as an example again, during Covid shutdowns, its Unclaimed Property Division provided a notice to holders informing them the final remit report and remittance due date was postponed. This extension resulted in the reporting window being extended from June 1, 2020, to August 15, 2020. Holders or agents of holders who were able to submit their Remit Reports and remittances during the original reporting period were encouraged to do so.

Undoubtedly, it would be helpful for all States to have well developed contingency plans for these inevitable extreme situations. As States do not all have obvious plans and/or do not all proactively communicate when adjustments are made, banks, credit unions, financial institutions, and other holders seeking guidance on the best alternative for any specific circumstances may contact us to discuss the details of your situation.

NAUPA III Is Moving Forward

Background: Since the 1990s, NAUPA has had an established standard format to make electronic reporting more uniform. While the NAUPA format was updated in 2003, 2010, and 2013, along with some State specific modifications, the programming is now completely outdated.

In due course, the limited number of fields and number of characters per field are more restrictive than what is needed for the broader range of property types now being reported, as well as capturing more owner information to increase the likelihood of unification.

Consequently, NAUPA embarked on the journey of a complete rewrite to:

- Add more flexibility for future additions;

- Make the format more logical;

- Add expanded and enhanced codes—including more property type descriptions;

- Allow the ability for more detailed reporting than the current fixed width field format

- Add expanded alternatives for combined holder reporting;

- Etc.

The long-anticipated rewrite uses Extensible Markup Language (XML) and addresses the weaknesses in the prior format. [7] [8] “XML is a language used for storing and transporting data. XML can be read and processed by computers but can also be human-readable. Tags label, categorize, and organize information in a specific way. A tag for a specific data element is placed between angle brackets (< >).” [9] This allows for longer information to be captured and for different fields for each piece of information.

With the understanding that States have different statutory, regulatory, and administrative reporting requirements, States will have modified versions to fit their specific reporting needs. Having the state-specific schema will greatly assist holders to appropriately program their systems and determine which data needs to be incorporated into the report file. This will be accomplished through each State having its own XML Schema Definition (XSD).

An XSD is used to express a set of rules to which an XML document must conform to be valid according to that specific schema. Although, unlike many other schema languages, “XSD was also designed with the intent that determination of a document's validity would produce a collection of information adhering to specific data types.” [10] The schema will also provide a means for more robust upfront data validation tools to be built.

Current Status: The NAUPA III rewrite has been developed and was sent to NAUPA members for feedback. Now, NAUPA is seeking feedback with an initial comment period ending on February 28, 2023. This provides the holder community, industry associations, software developers, etc. with the opportunity to provide feedback. The draft of the rewrite is viewable online on the NAUPA website at https://unclaimed.org/naupa3/. Feedback can be submitted through the Google form at the bottom of the page. If you’re a software developer who would like to provide feedback on the xml format and validation tools, you can view those in Github. [11]

Observation: Right now, it could seem confusing because there is so much information listed. This is to accommodate all State requirements. For example, there could be property type codes that are not applicable to all States, yet they are listed in the rewrite. This apparent overabundance of information will be reduced to a State-by-State basis, as specifics become available for each State.

Next Steps: After the feedback for the rewrite is collected and analyzed, it is likely that some changes will be made. The timeline for this is currently unknown and probably will be dependent on the feedback received. Therefore, how time-consuming this will be is currently undetermined.

Also, it remains to be seen how quickly State and holder systems can be programmed and tested once the final NAUPA III format is approved by NAUPA. Legislation requirements for States to secure funding through budgetary processes which can be a hurdle and take time. Also, holders will need new software and possibly processes, and need to purchase new software or perform interna programming to transition to NAUPA III, after it is approved.

It is important to note, specific details on transitioning to NAUPA III on a State-by-State level, as well as the timeframe when old and new formats may be concurrently accepted is unknown. NAUPA anticipates encouraging States to accept both formats for about a year and then fully transitioning to NAUPA III.

As we move into the transition period NAUPA advises when using any NAUPA format, to be careful to not mix and match which version is used within a single report. Check with the jurisdictions in which you will report to determine which version(s) of the NAUPA layout is accepted by them. In addition, check on the State specific XSDs to accommodate the uniqueness of each State and any required verifications that will be performed to have files be accepted. [12]

Legislation Highlights

Linking Assets Inc. monitors the progress of legislation relating to unclaimed property. Highlights of enacted and noteworthy pending legislation are provided here.

Linking Assets Inc. is not a law firm and does not render legal services or advice. The information in this UPdate is not intended to be substituted for legal advice, which can only be provided by an attorney.

CA AB 2280 enacted 09/13/2022, effective 01/01/2023, provides for an unclaimed property voluntary compliance program. The bill prescribes the requirements for a holder to participate in the program and for a Controller to waive interest assessments and is dependent on funding and the program being set up. This will be the first of its kind for California.

CA AB 2960 enacted 09/18/2022, effective 01/01/2023, among other things, this bill includes securities liquidation provisions. This bill will require the Controller to sell securities no sooner than 18 months, but not later than 20 months, after the actual date of filing of the required report, rather than the date the report was due.

DE SB 281 enacted and effective 06/30/2022, [13] the definition of property now excludes property of a foreign government, the federal government, any other State government, or any local or municipal government outside of Delaware. Other changes include a variety of provisions related to Voluntary Disclosure Program participation, audits, compliance reviews, record requirements, and claims provisions.

ILSB 62 enacted 05/06/2022, effective 01/01/2023, for amounts held on a payroll card, an indication of owner interest includes wages from an employer in the form of a recurring ACH credit previously authorized by the apparent owner; conversely, ACH credits are not an indication of owner interest if inactivity fees are assessed on the payroll card account.

MD HB 305 enacted 05/29/2022, effective 10/1/2022, owner notification provisions concerning holder due diligence and contact requirements. dormancy provisions are revised for specific property types tied in part on the date a holder has an owner's valid address. For banking and securities related property, the dormancy trigger is now based on a lost or RPO date.

NY SB 9630 enacted and effective 11/22/2022, provides a definition of virtual currency (VC) and VC held by any banking organization, corporation, or other entity is presumed abandoned after 5 years of inactivity. This bill does not require sale or conversion of VC, rather it requires reporting and remittance with other banking property annually on 11/10, with a period end date of 06/30. Bill authorizes comptroller to liquidate VC as soon as the comptroller deems practicable. Claimants shall be entitled only to the net proceeds of the sale.

WI AB 1027 enacted 04/08/2022, effective 04/10/2022, relates to changes corresponding with the federal Secure Act and various changes related to the Wisconsin Retirement System.[14]

WV HB 4511 enacted and effective 06/10/2022, removes the former provision of seven years for interest bearing, and adjusts the dormancy to five years for demand, savings, or time deposit, including automatically renewable time deposits after the maturity of the deposit. Contains details governing renewals of automatically renewable time deposits.

The dormancy period for VC is three years after the last indication of owner interest. Directs for the liquidation of VC anytime within 30 days of filing the report and to remit the proceeds. Specifying owners shall have no recourse against the holder or the administrator for any gain in value after liquidation.

RUUPA Watch

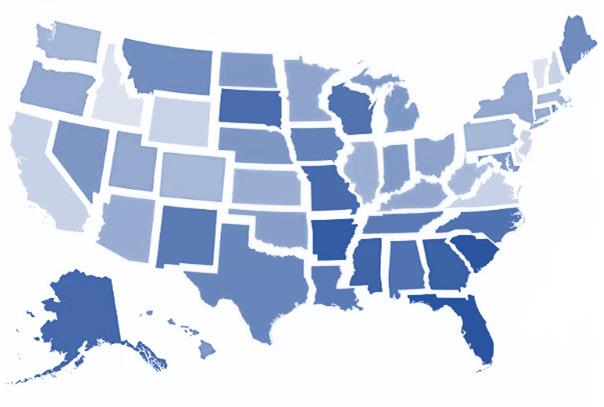

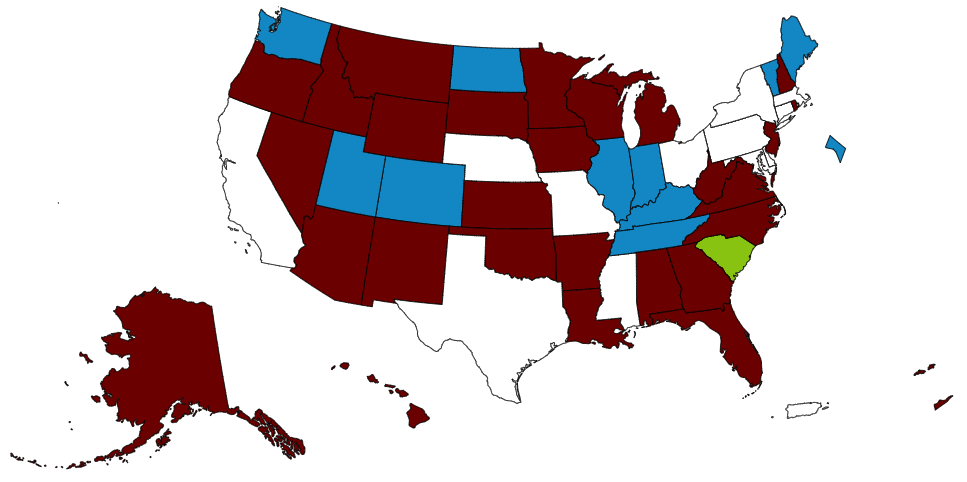

Jurisdictions with enacted versions of Uniform Law Commission’s (ULC) 2016 Revised Uniform Unclaimed Property Act (RUUPA) are shown below.[15]

In this Enactment Map:[16]

- Blue = RUUPA has been enacted

- Green = RUUPA has been introduced

- Maroon = a prior uniform act is in place

- White = Jurisdictions that have unclaimed property laws not based on any version of a uniform act

- [1] https://about.usps.com/newsroom/service-alerts/residential/welcome.htm

- [2] https://about.usps.com/newsroom/service-alerts/international/welcome.htm

- [3] Fla. Stat. § § 717.134.(5)

- [4] https://sco.ca.gov/Files-UPD/notice_to_holders_extension_request.pdf

- [5] https://sco.ca.gov/Files-UPD/Notice_to_Holders_Hurricane-Ian.pdf

- [6] Ibid

- [7] https://unclaimed.org/wp-content/uploads/NAUPAStandardElectronicFileFormat-11.20.19.pdf

- [8] https://nast.org/wp-content/uploads/naupa-iii-file-format-review-draft-1.1.pdf

- [9] Ibid

- [10] https://en.wikipedia.org/wiki/XML_Schema_(W3C)

- [11] https://github.com/NAUPAIII/NAUPA-III-Schema

- [12] https://unclaimed.org/naupa3/

- [13] Sections 1, 8, 9, and 10 of this Act take effect on enactment.

- [14] Sections 1, 9, and 10 bring State law into compliance with federal law changes to the required minimum distributions beginning age made by the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019. These Sections replace specified ages with a reference to the ages set under the relevant Internal Revenue Code section, so that future federal changes will be automatically reflected in State law. promulgated version.

- [15] Some States are introducing legislation labelled as being a revised uniform unclaimed property act, but they do not meet the ULC’s thresholds for being considered a RUUPA based on its 2016 promulgated version.

- [16] https://www.uniformlaws.org/committees/community-home?CommunityKey=4b7c796a-f158-47bc-b5b1-f3f9a6e404fa

- [17] Ibid